Reliable Tax-Refund Purchasing Service in Japan for International Customers and Businesses

By Macy -02/04/2024 UTC.

Did you know that most goods purchased from Japan incur a 10% consumption tax, typically already included in the product's price? To help international customers save on buying expenses, utilizing a tax-free purchasing service in Japan is a sensible option. In this article, we will introduce Japan's tax refund policy, how tax-refund buying services work and introduce you to a reputable and quality service - Ezbuy Japan.

Tax-refund policy in Japan

Regulations on purchasing tax in Japan

In Japan, the consumption tax (Japanese: 消費税, shōhi zei) is 10%, effective from October 2019. This tax applies to most goods and services purchased in Japan, including goods, food, beverages, dining services, accommodations and transportation. This means that when you purchase an item priced at 10,000 yen, you'll have to pay an additional 1,000 yen for consumption tax.

However, Japan is among the 60 countries with a tax refund policy zfor tourists or international customers using foreign currencies for shopping in Japan. Many customers are unaware of this policy, thus missing out on the opportunity to receive a tax refund for their purchases.

Items eligible for tax refund

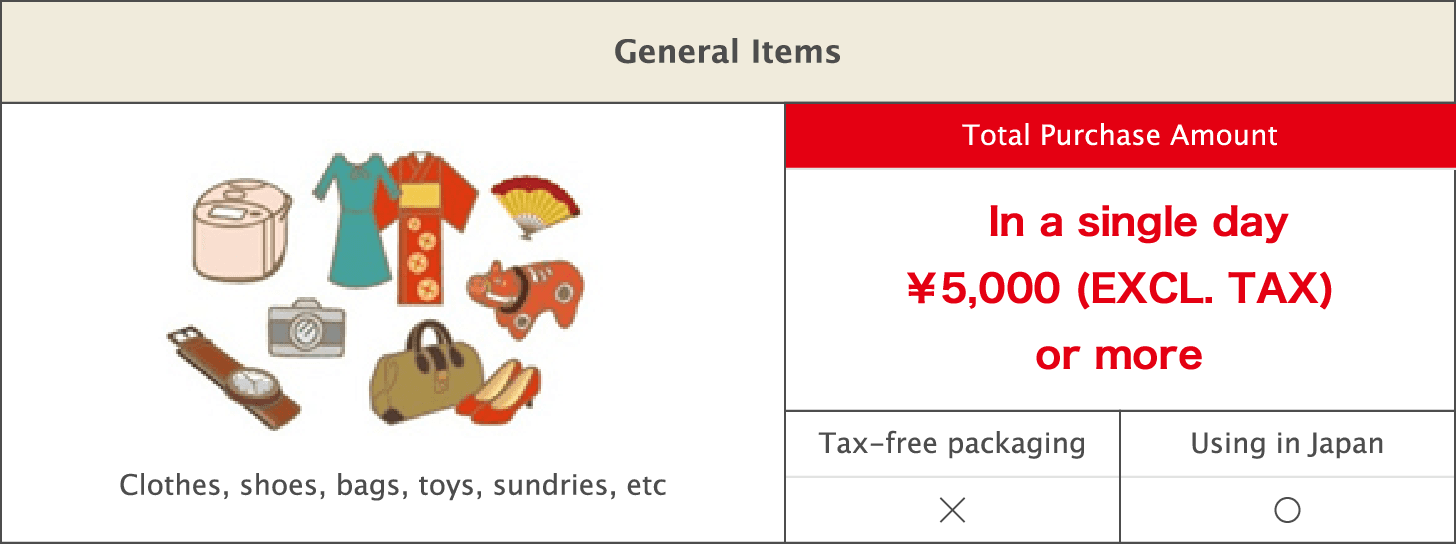

Not all items in Japan are eligible for tax exemption. Shopping categories eligible for tax exemption are classified into general items and consumables:

General items: household items, cameras, clothing, bags, shoes, souvenirs, watches and accessories. You must spend at least 5,000 JPY per day in this category to qualify for tax-free shopping.

Consumables: cosmetics, beverages (including alcohol), food, medicine, and confectionery. Transactions in this category must be valued from 5,000 JPY to 500,000 JPY and must not be used in Japan to qualify for tax exemption.

Note that consumables and general items cannot be combined for tax exemption. To register for exemption, you must spend a minimum of 5,000 JPY in each category.

How much tax is refunded?

The refund rate for eligible items is 8%. This means that when you purchase an item priced at 10,000 JPY, including tax, you'll receive a refund of 800 JPY. After deducting currency conversion fees, the refunded tax is typically around 4-5%. Additionally, to receive the refund, you must meet procedural requirements and provide necessary documents.

Guidelines for self-processing tax refunds when shopping in Japan

When the items meet the requirements and procedural criteria, you can self-submit a tax refund application. The sequence of steps for processing tax refunds is as follows:

- Tax refund form request: Obtain a tax refund form from the tax-fee counter at the store or at the airport upon departure.

- Fill out information and submit the form: Complete the form with all required information and submit it along with the purchased items to the tax-refund counter staff.

- Receive the tax refund receipt: The staff will process your refund application and provide you with a tax refund receipt.

- Track the refund status: Monitor the status of your refund application online or via phone.

- Receive the refund: Upon leaving Japan, you can receive the refund at the airport or through bank transfer.

These procedures are only applicable if you're a tourist making direct purchases in Japan. In case you're an international customer shopping through Japan's online platforms, you'll need to authorize someone to process the tax refund on your behalf, usually a proxy purchasing service or an external tax refund service.

Introducing tax refund purchasing service in Japan

If you're an international customer passionate about goods from the land of the rising sun, consider utilizing a tax-refund purchasing service in Japan. This service will help you optimize costs when buying from Japan.

How tax refund purchasing service works in Japan

Tax-free buying services in Japan are typically accompanying services provided by companies specializing in importing goods from Japan. Consequently, invoices and purchase documents are often under the name of the importing company, which acts on behalf of the customer to process tax refund documents for the purchased items. Once the tax refund is received, the company refunds it to the customer.

Fees for tax refund shopping service in Japan

Companies offering tax-refund shopping services in Japan usually charge fees based on the total value of the order. Some companies specializing in purchasing goods from Japan provide tax refund procedures for customers without additional fees.

Ezbuy Japan is one of the few companies offering this service free of charge to their customers. This helps customers save costs and gain additional benefits when using the service.

Why you should use Ezbuy Japan's tax-refund purchasing service in Japan

Ezbuy Japan is one of the leading e-commerce enablers, specializing in providing proxy shopping and quality tax refund purchasing services in Japan for both individuals and companies. Through janbox.com and the official API system connecting directly to famous Japanese e-commerce platforms, Ezbuy Japan has assisted hundreds of thousands of customers and businesses in Vietnam in purchasing Japanese goods at original prices, while also assisting customers in receiving tax refunds after purchase.

By partnering with Ezbuy Japan, you'll enjoy the following benefits:

- Purchase authentic Japanese goods at original prices: Janbox from Ezbuy Japan integrates with major Japanese e-commerce platforms such as Yahoo Shopping, Yahoo Auction, Rakuten, Rakuma, Amazon JP, eBay, and Mercari. Customers can find any item in Japan with just a search bar.

- Negotiate B2B purchases for businesses: As a legal entity company in Japan, Ezbuy is capable of negotiating with major brands in Japan on behalf of non-Japanese businesses to import large quantities of goods at original prices.

- Assist with tax refunds for customers: Ezbuy Japan handles tax refund procedures on behalf of customers for eligible items. The refund processing time is usually between 3 to 6 months.

- Free proxy shopping service for new customers: Janbox currently offers a free proxy shopping service for first-time individual customers.

- 24/7 customer support: Janbox is always available to assist you throughout the service usage process, including tracking order status, refund status, and addressing any inquiries you may have.

Tax refund purchasing service in Japan is a convenient and cost-saving solution for international customers when shopping or importing goods from Japan. With Ezbuy Japan, customers will enjoy professional and prompt tax refund buying services without incurring additional external service fees. If you have any inquiries about this service, feel free to contact Ezbuy Japan for consultation and assistance.